Solutions

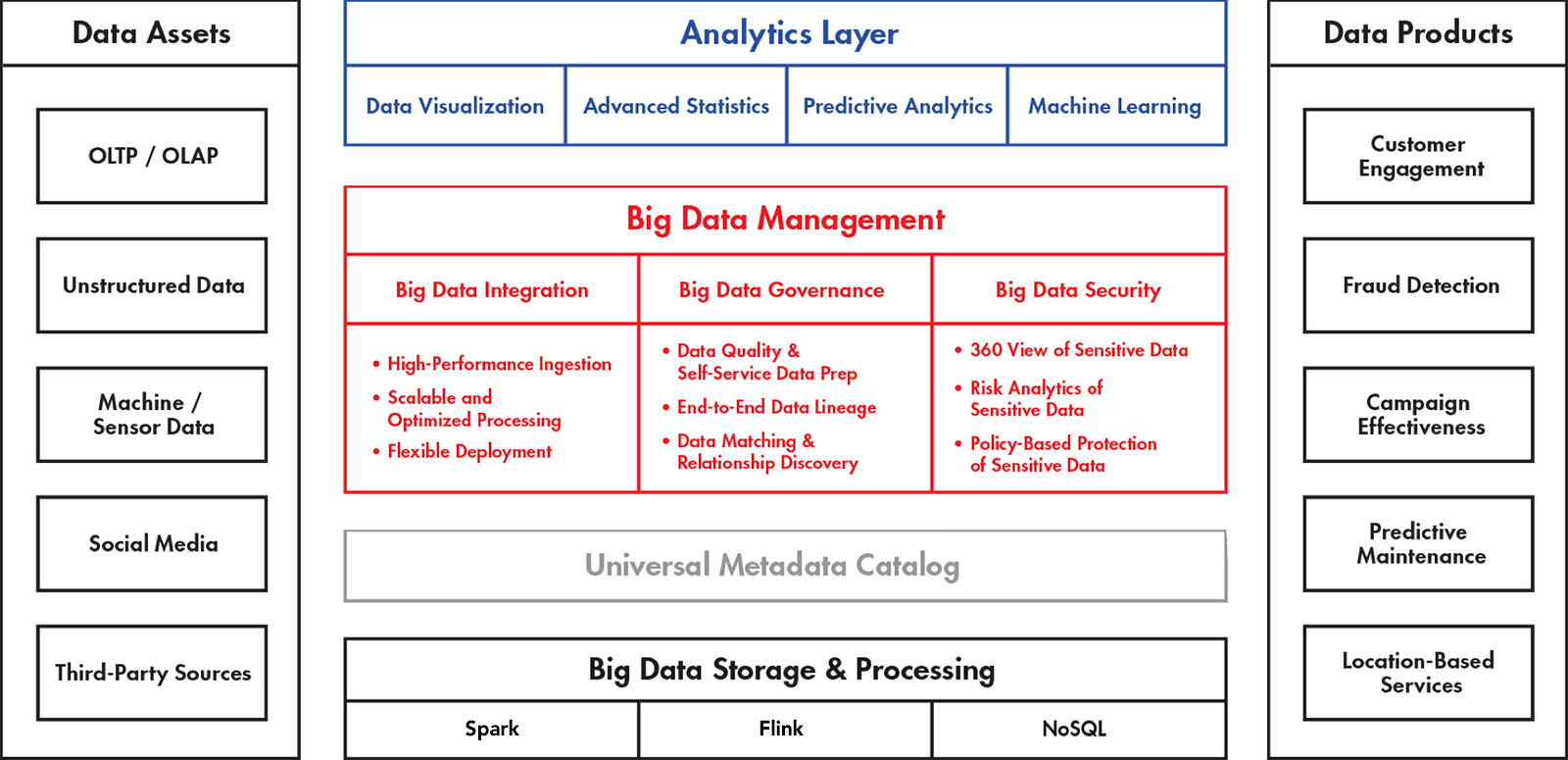

DataLux Platform

Focus on what really matters. Put data and analytics to work.

A data management and analytics platform built to address data challenges and enable real-time decision making.

DataLux comes with plug & play adaptors, providing aggregation of large data sets and the ability to gather and visualise insights in real-time.

Analyse

Visualise powerful analytics. Uncover hidden patterns, correlations and other insights.

Gain the value you didn’t realise you had.

Store & Source

Connect data sources and build your data set bottom up.

Use the data lake to pre-empt new innovations. Store data, ready for data modelling.

Deploy & Run Anywhere

Create portable applications by utilising containeristion in a public, private cloud or on premise.

Essentials

Ensure Enterprise-grade security and management.

Optimise for resource utilisation, integration and mastering data management.

Example Use Cases

Reconciliation

Automated financial reconciliation software for a range of financial data, including payments, bank, trade and accounts reconciliation with a plethora of connectors and adaptors. Helping your business to reduce time and resource spent on manual tasks.

Financial data

Bring multiple time-series market and inferred data together such as stock exchange tick data, stock market policy actions, related and cross-industry news, alternative datasets to extract causal information about stock markets, macroeconomics and more.

Engineering improvements

Learn through data with quasi experimentation to improve processes by designing tests, identifying metrics to work with. Conduct exploratory, look-back data analysis of counterfactual data produced inside and outside the platform.

Data & Front Office

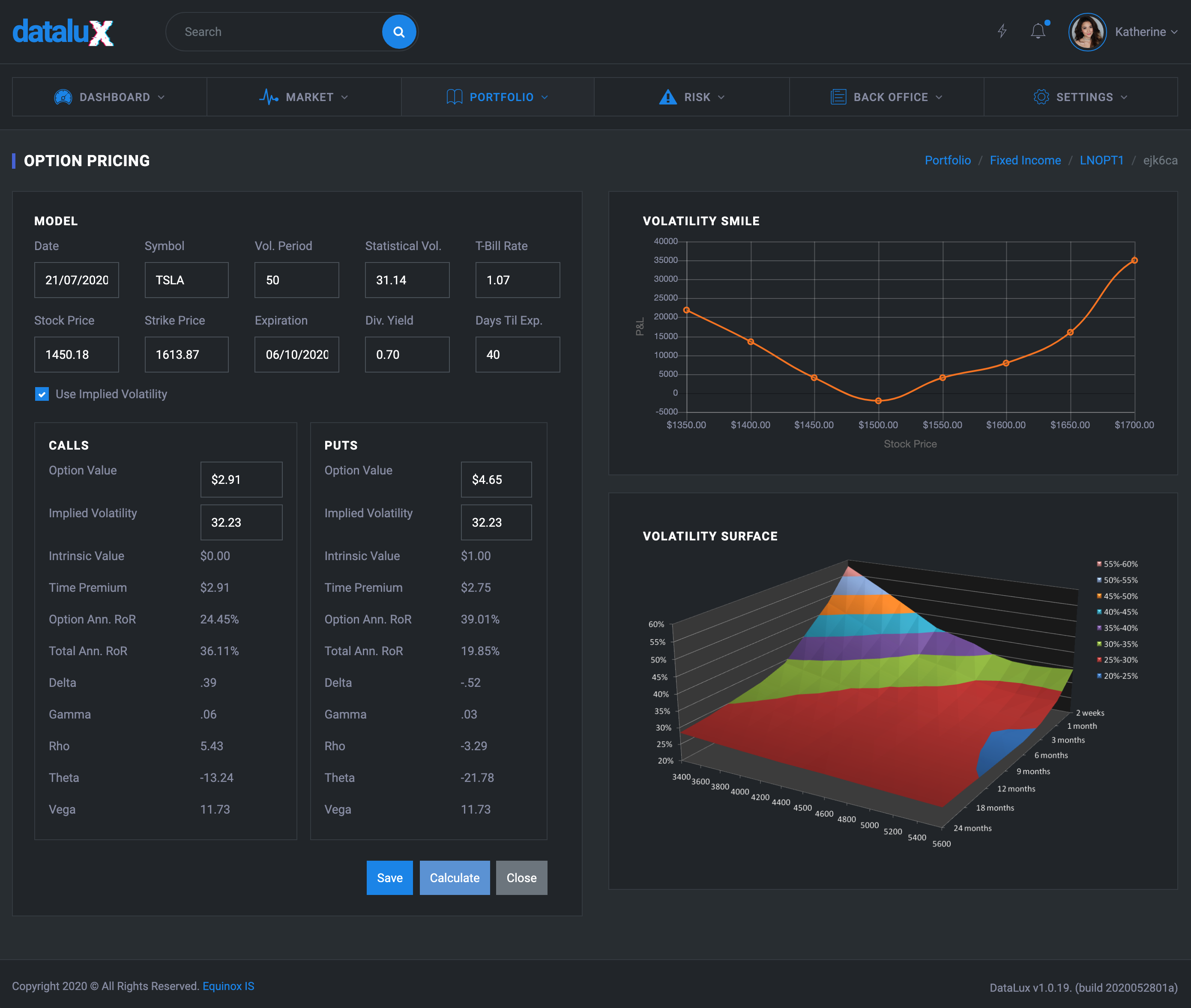

Access unique and timely insights and real-time portfolio information

- Market data feed handling

-

Alternative data

- Traditional, structured and non-traditional unstructured data

- Access it all from a single data source

- ESG data

- Transactions

- Documents, news, web processing (NLP)

- Satellite

- Portfolio management

-

Equities, fixed income, derivatives

- Trade capture

- PV

- Option modeller

- P&L report

- Web-based drilldown, pivot

- Excel plug-in

Middle & Back Office

Understand risk, model scenarios and save time by automating tasks

- Workflow based automation

- Custom reporting

-

Market Risk

- Scenarios

- Greeks

- VaR

- Credit Risk

- Regulatory reporting

- Transaction processing

- Settlements

- Reconciliation

- Collections

- Treasury functions

- SWIFT message processing

- Easy integration with other systems

White Papers

ESG, impact investing

Closing the gap with alternative data

- Make more informed decisions and ways of generating alpha

- Unearth new information using alternative & analytics data

- Automated question answering NLP for ESG

SME Finance

Improved risk management

- Handle large portfolios with ease

- Create custom scenarios for stress tests

- Reduces effort to comply with regulations

FinTech

Lending

- Automate loan origination

- Create workflow based execution for efficiency

- Integrate seamlessly with third-party solutions

Insurance

Real-time weather forecast notification

- Preventative, scalable system to notify users before potentially dangerous events occur

- It reduces the number of insurance events